Managing cash flow is one of the most critical aspects of running a successful business. Efficient cash flow management ensures timely payments, maintains healthy working capital, and keeps operations running smoothly.

Invoice factoring tools have become essential for businesses to optimize these processes, offering solutions tailored to various industries and business sizes. Here’s a look at some of the most reliable tools in 2024 that help simplify and enhance cash flow management.

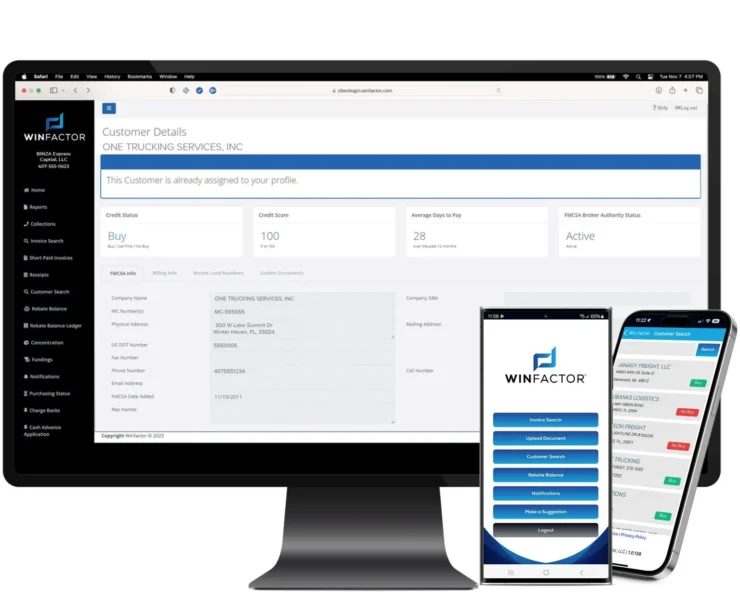

1. WinFactor

WinFactor is a powerful invoice factoring software tailored for the transportation sector. Designed with over 28 years of expertise, it integrates advanced AI and OCR technologies to deliver real-time invoice processing, credit monitoring, and fraud detection tools.

Key Features:

- Comprehensive platform covering all aspects of invoice factoring.

- Flexible submission options with automated document processing.

- Integrated credit and fraud protection for secure operations.

Ideal For: Factoring companies in the transportation industry looking for an all-in-one, reliable platform.

2. QuickBooks Online

A household name in financial management, QuickBooks Online provides a range of features that cater to small and medium-sized businesses. Its ability to handle invoicing, expenses, and cash flow tracking in real-time has made it a top choice.

Key Features:

- Integrates seamlessly with platforms like Shopify and PayPal.

- Customizable financial reports and automated payment reminders.

- User-friendly interface for straightforward cash flow tracking.

Ideal For: Small to medium-sized businesses seeking a scalable, versatile accounting tool.

3. Float

Float stands out with its focus on cash flow forecasting, helping businesses anticipate financial trends. Its compatibility with Xero, QuickBooks, and FreeAgent ensures smooth integration into existing accounting systems.

Key Features:

- Advanced forecasting tools for precise financial insights.

- Scenario modeling for strategic planning.

- Visual dashboards offering a clear understanding of cash flow.

Ideal For: Companies requiring detailed forecasting and scenario planning.

4. Pulse

Pulse is a straightforward cash flow management tool that prioritizes ease of use. With its simple interface, it helps businesses track income and expenses effortlessly.

Key Features:

- Customizable budgeting and financial reporting tools.

- Real-time cash flow visualization.

- Minimal learning curve, perfect for new users.

Ideal For: Small business owners needing an intuitive and effective tool for cash flow management.

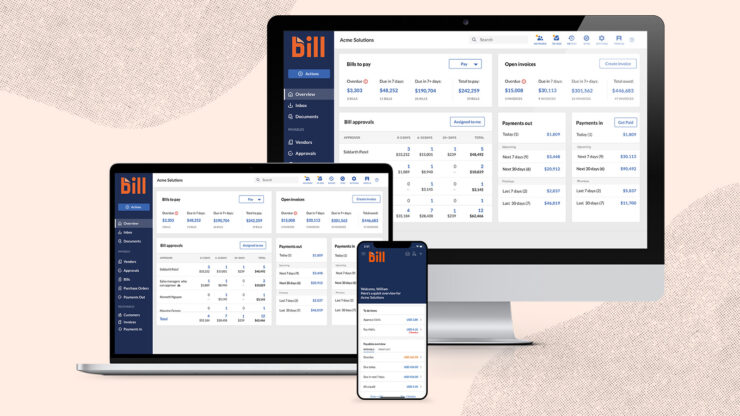

5. Bill.com

Bill.com simplifies accounts payable and receivable workflows, allowing businesses to automate payments and approvals. Its integration capabilities make it a valuable addition to existing accounting platforms.

Key Features:

- Automated payment processes and approval workflows.

- Real-time dashboards for financial oversight.

- Handles both domestic and international transactions seamlessly.

Ideal For: Businesses managing high transaction volumes and requiring automated solutions.

6. Fathom

Fathom delivers advanced financial intelligence by combining data-driven insights with detailed reporting. Its integration with leading accounting software makes it a favorite among professionals looking for strategic financial analysis.

Key Features:

- Scenario modeling for future planning.

- Comprehensive KPI tracking and reports.

- Integration with Xero, QuickBooks, and MYOB.

Ideal For: Companies aiming for actionable insights into cash flow trends.

7. Sage Intacct

Sage Intacct offers enterprise-grade financial management tools, catering to businesses with complex financial needs. With multi-currency support and predictive analytics, it provides unmatched cash flow visibility.

Key Features:

- Supports multi-currency transactions and advanced forecasting.

- AI-powered analytics for better decision-making.

- Integrates with enterprise systems for a unified financial view.

Ideal For: Large enterprises with diverse and complex financial operations.

8. FreshBooks

Originally developed as an invoicing tool, FreshBooks has expanded into a full-fledged accounting solution. It’s especially popular among freelancers and small service-oriented businesses.

Key Features:

- Automated expense categorization and invoicing.

- Cash inflow and outflow management tools.

- Intuitive interface for non-accounting professionals.

Ideal For: Freelancers and small businesses seeking an accessible and reliable financial management platform.

9. Zoho Books

Part of the Zoho suite, Zoho Books offers a blend of invoicing, accounting, and cash flow management features. Its integration with other Zoho applications creates a cohesive system for businesses using the platform.

Key Features:

- Automation of recurring invoices and expense tracking.

- Strong compatibility with both Zoho and external platforms.

- Project-based financial tracking for specific needs.

Ideal For: Small businesses already utilizing Zoho’s ecosystem.

10. Wave

Wave provides essential financial management tools free of cost, making it an excellent choice for startups and freelancers. Despite being free, it covers all the basics of invoicing and expense management.

Key Features:

- Free solution for fundamental cash flow management tasks.

- Includes receipt scanning and invoicing features.

- Simple setup suitable for budget-conscious businesses.

Ideal For: Startups and small businesses looking for cost-effective cash flow management tools.

How to Choose the Right Invoice Factoring Tool

With so many options available, it’s essential to focus on what matters most to ensure the tool not only addresses immediate cash flow concerns but also supports long-term financial stability.

Start with Business Needs

Every business is unique, so the first step is understanding what features are non-negotiable. Some companies may prioritize advanced forecasting to anticipate future cash flow trends, while others need automation to save time on repetitive tasks like invoicing or payment reminders. A transportation company, for instance, might find the specialized tools offered by WinFactor invaluable, while a small startup could benefit from a simple, free solution like Wave.

Consider Your Scale and Complexity

The size and complexity of your business operations often dictate the sophistication of the tools you’ll need. For smaller businesses or freelancers, platforms with an intuitive design and straightforward functionality—like FreshBooks or Pulse—are often the best choice.

Medium-sized businesses, on the other hand, may require tools like QuickBooks Online that offer scalability and the ability to integrate with multiple platforms. Enterprises operating at a large scale, especially those handling multi-currency transactions or managing complex workflows, are better suited to solutions like Sage Intacct, which cater to intricate financial environments.

Look at Integration Possibilities

How well a tool integrates with your current systems can make or break its usefulness. Seamless compatibility with existing accounting software like Xero or QuickBooks can simplify adoption and ensure smoother operations. Businesses already using ecosystem-driven platforms like Zoho may find that Zoho Books provides everything they need for cash flow management without requiring additional tools.

Factor in Your Budget

Some businesses operate with tight financial constraints, which makes free or low-cost options like Wave particularly appealing. However, if your operations demand robust features such as scenario modeling or advanced analytics, tools like Fathom or Sage Intacct, while pricier, can provide the value needed to justify the investment.

Prioritize Efficiency and Automation

Efficiency is the backbone of effective cash flow management, and automation plays a key role in achieving it. Platforms like Bill.com or QuickBooks Online can handle repetitive tasks like generating invoices or sending payment reminders, freeing up valuable time for other priorities. Automating approval workflows or integrating real-time dashboards can also significantly reduce errors and ensure a smoother financial process.

Consider Industry-Specific Features

Certain industries benefit from tailored solutions. For example, a transportation-focused business might lean toward WinFactor due to its specialized design for the sector, while service-based companies may need tools that simplify invoicing and expense tracking, such as FreshBooks.

In Summary

Each tool listed brings unique strengths, from advanced forecasting to seamless integrations. By leveraging these solutions, businesses can maintain healthier cash flow and focus more on growth rather than financial bottlenecks.